Cash-less Cash Envelope Alternative

So I’m willing to bet that a lot of you are like me, and have never gotten fully into Dave Ramsey because you hated the idea of carrying cash, having to go to the bank and get exact amounts of cash out, etc… the day I go to pull hundreds of dollars out of the bank is the day I lose a bunch of it, I swear. So, I’ve been wanting to get crafty with my bank accounts for a while. I’ve got your typical checking and savings, but I’ve been wanting to have things separate so I have an account just for bills. That’s when I got the idea to have three accounts- one for bills, one for “cash envelopes” or other spending, and one for sinking funds & my emergency fund! So, I’m setting those up and I created a printable that you can use along with your “cash envelopes” account to keep track of that spending, if you want to do the same for a cash envelope alternative.

This post contains affiliate links. See our full disclosure policy, here.

Sign up for my email list to download your free Cash-less Envelopes printable.

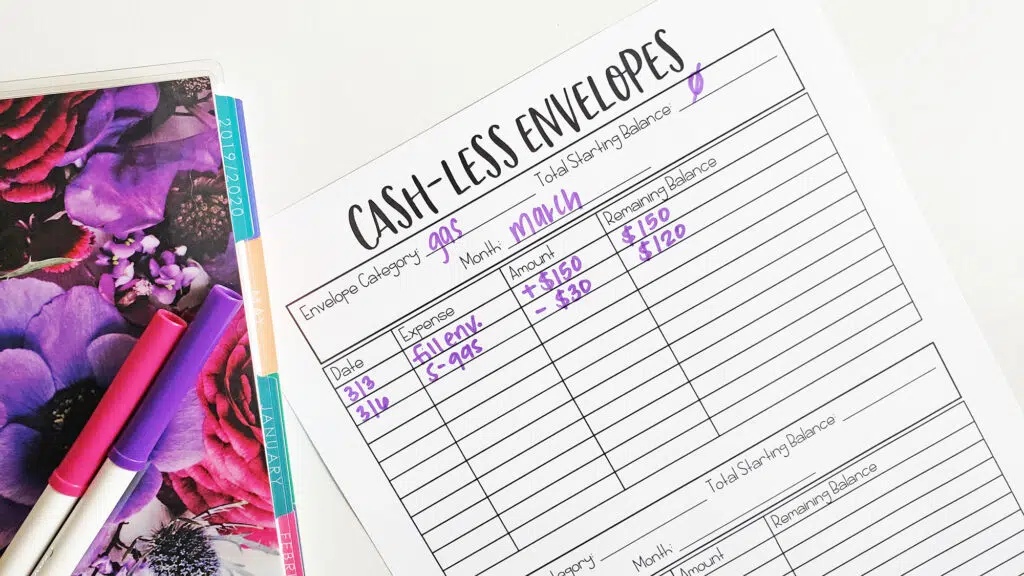

First, you write what “cash envelope” category that you are working with. There are 2 per page, I have 9 categories right now, so I printed 5 copies. Once you write down your categories, if you are just starting out with the cash envelopes concept you can put a zero starting balance, or if you are ready to fund your new “cash envelopes” account you can do that, and write down the amounts you’ve added for each category on their starting balances.

My plan is to use one sheet per month, but if you’d rather do one sheet per week or do it biweekly, you can do that, too. I’m going to do one sheet per month, but actually do my deposits weekly. So, whenever I’m adding money I’ll just document that, put a + sign, then the amount deposited and calculate the new balance.

Any time you want to check that your “cash envelopes” account has the correct balance, you can simply add up the balances from each envelope category you have and see if they match your balances for your bank account, taking note of any transactions that haven’t cleared yet, just like you would reconcile a regular bank account.

So there you have it. We’ll have a debit card for bills, which we can leave at home, since I do all of the bill paying online or over the phone, and then we’ll have a card for our separate account that we can use to spend our “cash envelope” funds. Another great option would be to use the Every Dollar app to keep track of the funds, too, since you can check the app from your phone and make sure you are on track. However, I know a lot of us do better with pen and paper and it takes just a few seconds each day to keep up with it.

So there you have it, my Cash-less Cash Envelope System alternative that I’m using to budget every penny and stay on track with my finances. Let me know in the comments what you’d like to learn next about budgeting.

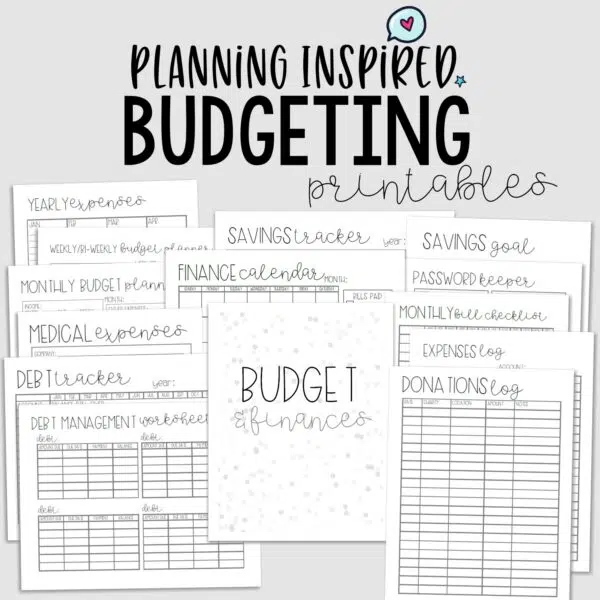

Also, don’t forget you can grab these budgeting printables from my printable shop to help get your whole budget in order.

You might also like these budgeting posts-

One Comment