What Are Sinking Funds?

This post may contain affiliate links. See our full disclosure policy, here.

When it comes to budgeting, and especially budgeting with Dave Ramsey, I hear a lot of questions about sinking funds. What are Sinking Funds? Sinking funds have got to be one of my favorite parts about having a budget. However, I’ve seen a lot of confusion around them, and a lot of people wondering just what exactly they are for. Let’s break it down.

This post contains affiliate links. See our full disclosure policy, here.

What are sinking funds?

To sum it up, where your emergency fund is a fund that you put in place for emergencies- the pipes burst, someone breaks an arm, etc etc… Anything that could be considered an emergency is typically covered under the emergency fund.

But then, there are the sinking funds. These are funds that you “sink” money into each month. They are typically for annual, expected, sometimes unexpected, expenses. When it comes to the unexpected with sinking funds, it is sort of like planning for the unexpected.

Sinking funds allow you to cover both needs and wants. You could create a sinking fund for household upgrades, or you could create a sinking fund to save for a vacation. A few expenses that I have sinking funds for would be my once a year homeowners association dues, my once a year vehicle taxes and tags. I like to create sinking funds for things that I know are coming, that I don’t want to get caught off guard for with a big expense all in one month. Another great example for my sinking funds would be a back to school fund to buy clothes, school supplies, etc.. for my kids.

You might want to create a car sinking fund if you are driving your “Dave car” that you are pretty sure might have some unexpected expenses in the near future. New tires for your car are another great example.

You could create a Christmas sinking fund, and that would get rid of any guilt associated with a normally expensive time of year because you have saved ahead.

How much should you save?

If you are wondering how much you should save, that really just depends on what you are saving for and how much you need. If you just paid for your vehicle taxes and tags, you know that you have 12 months until that expense comes around again. So, you could take the amount you just paid (even with assuming it may be less next year because taxes typically go down), and divide that over 12 months. For an example, let’s say vehicle taxes and tags cost you $300. If you have 12 months to save, you need to save $25 a month to cover those.

Let’s consider that maybe you are starting a sinking fund and you don’t have 12 months to save up. For example, both of my boys have birthdays in December, so I’d like to save $500 to fund both of their birthdays. It is February now, so I really only have 10 months to do this. I need to save $50 per month in order to fund that sinking fund on time. Also, another thing to consider is that if you are debt free, whenever you have extra money throughout the month, or let’s say you have a garage sale or something and make extra money. You could fund those things early if possible.

How to store sinking funds

I will always tell you guys that I am not a fan of cash envelopes or keeping a bunch of cash on hand. However, a great option is finding a bank that allows you to have free savings accounts. Then, you could create a savings account for each sinking fund. It doesn’t have to be super detailed with 100 savings accounts, you could lump a couple of things together. I am looking forward to opening savings accounts for my sinking funds this year, and I know I’ll want a “house” sinking fund, a “cars” sinking fund, and a sinking fund for my boys- an account to store the funds for things like back to school, birthdays, and Christmas.

How to organize sinking funds

Honestly, you can write them down with pen and paper in a notebook, but a great option would be my printable savings tracker. If you used the savings account idea, you could use one sheet for each account and keep track of funds added or funds taken out of each account, each month. That way, you can keep an eye on your goals and your progress with everything that you need to fund.

I also have savings goals printables that might come in handy if you are doing a large sinking fund for something like a vacation. That would allow you to set goals monthly for that sinking fund and to keep track of how much you have saved.

You can get my Savings Tracker printable by signing up for my email list below!

But- I’m barely affording my bills.

I understand that this may be the situation for many people who are trying to get out of debt. When I first began thinking about sinking funds, I thought to myself, I’m trying to just stay afloat, I don’t have the money to be adding to these sinking funds every month. That’s where tough love from Dave Ramsey would come into play and he would tell you that you have an income problem. It might be time to get a 2nd job, reduce expenses, or find some way to make additional money to fund these things and get out of debt even faster. If you are trying to get out of debt, your progress is going to be a lot slower if each month you have large expenses popping up that you knew about in advance, and could have saved for. I know it can be difficult, but I also know it can be so worth it.

If you are new to Dave Ramsey’s budgeting style, I will say that we follow it loosely- for example, we don’t necessarily drive “Dave cars” or pay cash for our vehicles (yet), but I still really love his principles and follow along with his plan. I recommend reading or listening to the Total Money Makeover book and even taking Financial Peace University if you can, if you want to get ahold of your money and start telling it where to go, instead of wondering where it went.

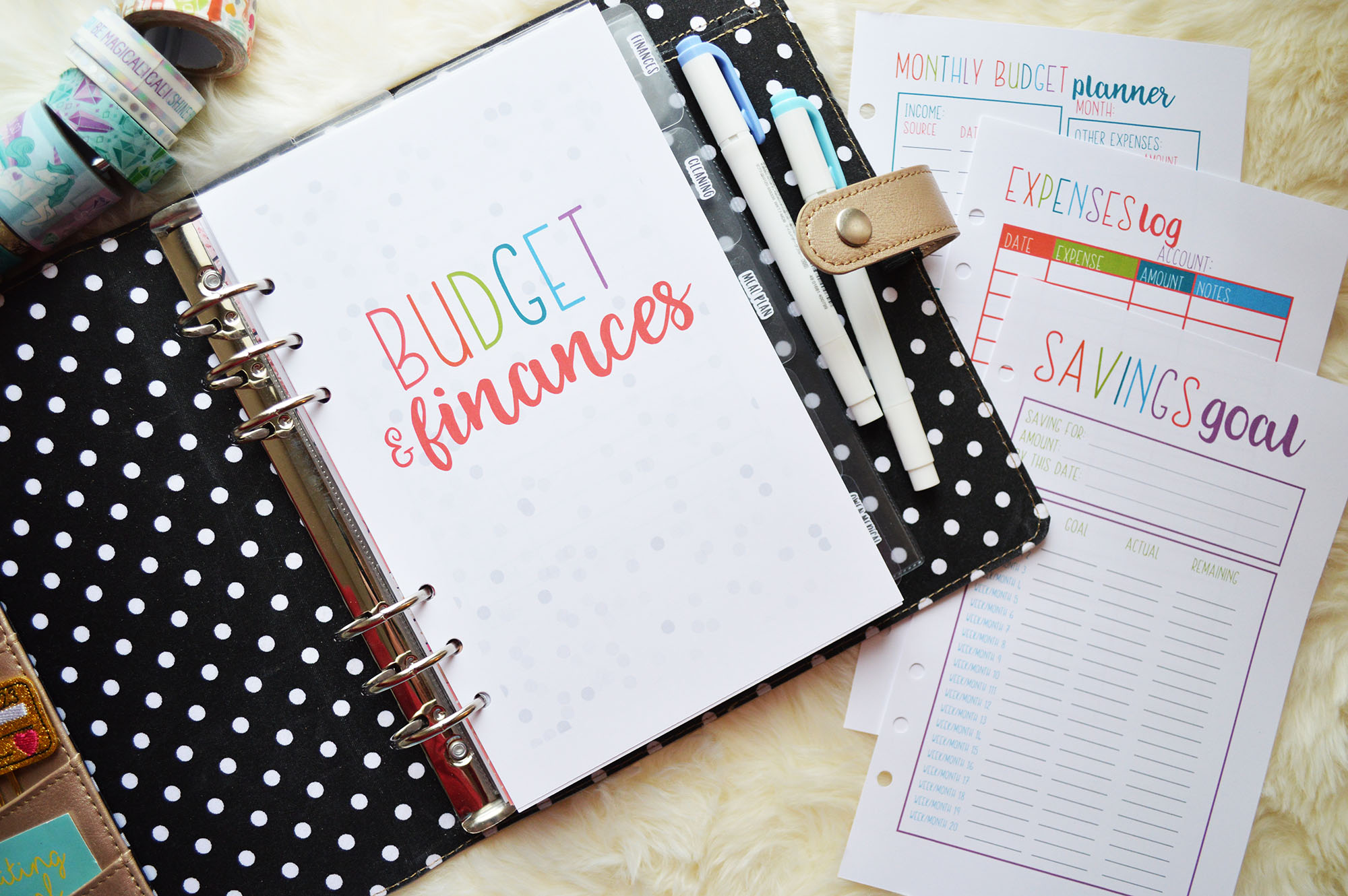

I’ve also got some really helpful printable Budgeting planners available for FREE that can help you be more organized with your finances. I’ve got a couple of color styles, and they come in two sizes- letter size and half letter size (a5 size for all the planner folks).

Check out these other budgeting tips!

How to Stop Living Paycheck to Paycheck

Get my budgeting printables by signing up for my email list below!